Everything You Need to Know about KYC in Crypto

If you’ve ever tried to sign up for a crypto exchange and were asked for a selfie and a picture of your passport, you’ve met KYC or Know Your Customer. KYC in the crypto industry is a safeguard verifying who’s behind those crypto wallet addresses and keeping things legitimate and safe.

In fact, as of 2025,over 85% of regulators worldwide require crypto exchanges to implement KYCchecks, and an estimated 92% of major crypto exchanges are now fully KYC-compliant. For businesses – KYC is a legal lifeline, for users – it’s the pathway to a safer financial future.

Let’s dive into everything you need to know about the KYC process in the crypto world.

What is KYC in Crypto?

KYC is a mandatory process used by financial institutions to verify the identity of their clients. In the crypto space, it’s the primary tool used by Virtual Asset Service Providers (VASPs), such as exchanges and custodial wallets, to prevent illicit activities like money laundering, terrorist financing, fraud, and sanctions evasion in the crypto ecosystem.

In practice, it means a crypto exchange, broker, or wallet provider will collect personal information and documents from users to confirm who they are. Although cryptocurrency was primarily built on pseudonymity, global regulators like the Financial Action Task Force (FATF) have made it clear as day: if you’re moving money, you need to know who is behind the keyboard.

Over 120 countries have already enacted KYC/AML rules for crypto businesses, making identity verification a standard expectation. Source

How Does KYC Work in Crypto?

KYC for a crypto exchange or platform is a multi-step process to confirm a user’s identity and assess their risk. Modern KYC workflows combine document verification, biometric checks, and database screenings, often powered by AI.

In crypto, KYC starts with identity verification, then layers on AML checks and risk scoring to flag high-risk users. Exchanges require KYC verification for buying or selling with regular money (like dollars), but wallets differ. Custodial wallets, such as Coinbase, act like exchanges and need it too, while non-custodial ones, like MetaMask, usually don’t, so users hold their own private keys there.

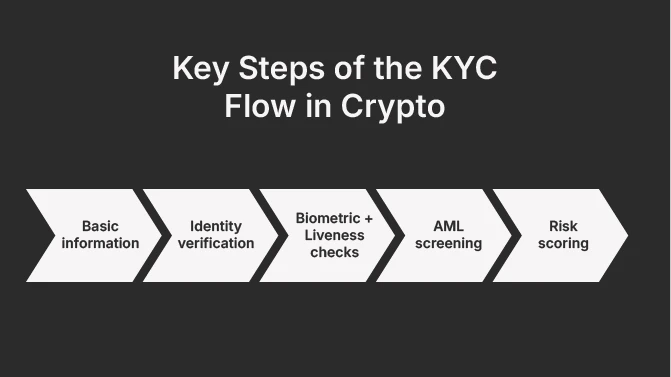

The step-by-step KYC flow in crypto:

- Basic Information. Users provide their name, date of birth, address, and contact details through a sign-up form. Some platforms also request nationality or ID numbers as legally required.

- Identity Verification (IDV). Users submit government-issued ID (passport, driver’s license, or ID card) and sometimes proof of address (utility bill or bank statement). The system checks if the document is authentic and matches the provided information using technology like OCR and hologram detection.

- Biometric + Liveness Check. Users take a selfie or video to prove they’re the actual ID owner. The system uses facial recognition to match the selfie with the ID photo and asks users to blink or move to confirm they’re a real person, not just holding up a printed photo.

- AML Screening. The platform checks the user’s name against global Anti-Money Laundering (AML) databases, sanctions lists, Politically Exposed Persons (PEP) databases, and fraud watchlists. This ensures users aren’t banned individuals or high-risk persons who need extra scrutiny.

- Risk Scoring. The system assigns a risk score based on location, occupation, and screening results. Low-risk users get approved automatically. High-risk users may need additional review, such as Enhanced Due Diligence (EDD), before accessing their account.

This entire KYC process has become highly automated on many crypto exchanges with the help of AI that performs document recognition, face matching, and database checks within seconds. As a result, the average verification time on major exchanges is now just a few minutes.

However, not all crypto services are the same when it comes to KYC obligations. So, let’s discuss the difference between wallet and exchange KYC.

Crypto KYC Requirements for Exchanges and Wallets

It’s also important to understand the difference between the wallet and exchange KYC. Thus, exchanges and custodial wallets (where a company holds your crypto) require full KYC because they manage funds on your behalf and must follow regulations.

Meanwhile, non-custodial wallets (like MetaMask or hardware wallets) typically don’t require KYC because you control your own private keys and funds directly, meaning no company is handling transactions for you.

Put simply: if you’re just using software to manage your own crypto, there’s no KYC needed. But once you use an exchange or custodial service, KYC is required.

Do Crypto Exchanges Require KYC?

Yes. Almost every major crypto exchange now requires KYC, thanks to FATF, the EU’s MiCA/AMLR, and the US FinCEN under the Bank Secrecy Act (BSA) requirements that treat exchanges as Money Services Businesses (MSBs), which triggers the application of the Customer Due Diligence (CDD) for all users.

By enforcing KYC, exchanges protect themselves from becoming „mule” accounts for hackers. For example, the world’s largest cryptocurrency exchange – Binance enforces it globally to avoid fines, blocking unverified trades over thresholds.

Do Crypto Wallets Require KYC?

Custodial wallets, such as Coinbase or Binance, require KYC, because they hold your funds, so they act as financial institutions. Non-custodial wallets, such as MetaMask or Ledger, generally do not, since they don’t hold your „money” – they just provide the software to access the blockchain. This means they currently fall outside many KYC requirements. However, the moment you try to swap crypto for „real” cash, the service provider you use will ask for your ID.

What Documents are Needed for Crypto KYC?

Depending on where you live, you’ll typically need:

- Proof of identity: Passport, national ID, or driver’s License.

- Liveness detection/biometric check: A real-time selfie or video.

Proof of address: A utility bill or bank statement, usually for higher trading limits, varying by jurisdiction like EU’s stricter MiCA rules.

In-House vs. Third-Party KYC for Crypto Companies

For crypto businesses (exchanges, brokers, fintech apps dealing in crypto), one big strategic question is whether to manage KYC compliance in-house or to outsource it to specialized third-party providers.

Building an in-house KYC program means developing or licensing software, hiring compliance officers and verification staff, and continuously updating processes. On the other hand, using a RegTech or KYC-as-a-service provider (like Ondato) means much of that heavy lifting is handled by an external platform. Each approach has pros and cons, but there are some clear challenges with doing everything in-house, especially for smaller companies.

Let’s zoom in on the key challenges of in-house KYC:

High costs. Running KYC internally is expensive, requiring verification technology, compliance staff, and ongoing maintenance. A single compliance mistake can result in massive fines. Third-party providers often offer cheaper solutions by serving multiple clients.

Average compliance costs for small-to-mid crypto firms rose approximately 28%, reaching around $620,000 annually. Source

Scalability issues. Manual KYC processes struggle with user growth and create bottlenecks. For example, lengthy verification procedures tend to annoy customers and can cause them to drop off mid-signup. Typically, manual reviews can take days, and most users won’t wait 48 hours to buy a coin – they’ll just go to a competitor.

Meanwhile, third-party services handle volume spikes better with automated systems, optimized interfaces, and 24/7 coverage, improving customer retention without requiring companies to build everything themselves.

Around 25% of users abandon onboarding due to KYC friction, i.e. if the process is too slow or complicated. Source

Regulatory and fraud challenges. Regulatory compliance in crypto constantly changes, and fraudsters develop new tactics. In-house teams must track legal updates across all jurisdictions and detect sophisticated fake IDs or synthetic identities – all these are difficult tasks. In contrast, third-party providers stay current with regulatory changes and use advanced technology (AI, biometric verification, database checks) to detect fraud more effectively than most individual companies can manage alone.

Data accuracy issues. Building AI that can spot a fake „deepfake” selfie is incredibly hard, expensive and can lead to mistakes. For example, a fraudster steals a victim’s ID and photo and uses a face-swap app to create a deepfake video. When signing up for your exchange, this deepfake passes your in-house system’s checks, because it detects eyes, nose, mouth, and even sees how the fraudster blinks and smiles on command. The basic AI sees a perfect match with the stolen ID and approves it. The problem? Your in-house AI only analyzes pixels, which can be faked. It can’t detect that the „person” is actually a digital overlay from a virtual camera.

Why KYC Matters in the Crypto Industry

KYC is fundamental for the health and legitimacy of the crypto industry. Once created with privacy and decentralization at its core, cryptocurrency can’t stay anonymous. It needs to be transparent for it to be accepted by the world’s biggest banks and pension funds.

Statistics show that the volume of illicit crypto dropped to 0.4% of total volume in 2024, which is largely due to better KYC and AML protocols making it harder for criminals to hide. Here are key benefits of KYC in crypto:

Legal compliance. The overwhelming majority (86%) of crypto regulatory actions from 2019–2024 involved KYC/AML violations. Which proves that following the KYC rules helps companies avoid heavy fines, keep their licenses, and prevent being shut down by regulators. By verifying identities, businesses act as partners in preventing financial crime rather than being seen as high-risk targets for law enforcement.

Building trust. KYC signals that a platform is a professional, long-term business rather than a „fly-by-night” operation, which, in turn, builds confidence for everyday users who want to know their funds are safe from scammers. More so, institutional investors and banks will only partner with crypto firms that have strong compliance protocols in place.

76% of crypto users believe KYC enhances platform security and trust, while 67% of institutional investors require strong KYC protocols before partnering with crypto platforms. Source

Reducing crime. Crypto platforms without KYC are 10 times more likely to be used for illegal activities. KYC helps deter criminals, which reduces the overall amount of fraud, hacking, and money laundering in the industry. It also protects innocent users and improves the reputation of the entire crypto market. A cleaner ecosystem encourages more people to participate, knowing that the people they are transacting with have been vetted.

Preventing regulatory backlash. When crypto companies proactively self-regulate through KYC, they reduce the need for governments to step in with harsher, more restrictive laws. KYC in crypto demonstrates that the industry can be responsible and integrated into the global financial system, leading to more balanced and sustainable regulations.

Securing future growth. Finally, KYC is essential for mass adoption and advanced services like lending, debit cards, and bank integrations. It provides the foundation for crypto to offer traditional financial services safely and supports emerging standards like the Travel Rule.

AML in Crypto: How It Works

Alongside KYC goes AML – the broader program of measures that crypto companies use to detect and prevent illicit transactions. If KYC is about knowing the customer at onboarding, AML is about monitoring what customers do and managing risks throughout their relationship with your platform.

So, in the context of crypto, AML involves things like transaction monitoring, blockchain analysis, sanctions screening, investigating suspicious activity, and reporting to authorities when needed.

While KYC checks who you are at the door, AML watches what you do once you’re inside.

Transaction Monitoring

Transaction monitoring, also known as KYT – Know Your Transactions, continuously scans crypto transactions for suspicious activity using blockchain analytics tools like Chainalysis or Elliptic. This means identifying „red flags”, such as, for example, when a brand-new account suddenly tries to move $1 million in „mixed” coins.

The red flags include: using mixers or privacy coins, structuring (multiple transactions just under reporting thresholds), interacting with high-risk sites, and rapid cryptocurrency swapping.

To sum up, transaction monitoring checks if funds come from risky sources (darknet markets, mixers), flags unusual patterns (dormant accounts making large transfers, rapid buy-and-withdraw activity), and assigns risk scores to transactions and addresses.

EXAMPLE: A crypto trader normally trades under $5,000, but suddenly receives multiple $9,900 deposits, converts to Monero, and withdraws everything – this is flagged as potential money laundering.

And when suspicious activity is detected, compliance teams investigate and may file Suspicious Activity Reports (SARs) with regulators.

Sanctions and PEP screening

These are critical AML elements that make sure a crypto business is not dealing with high-risk political figures, prohibited parties or high-risk/sanctioned individuals or entities.

Sanctions screening checks if customers or transaction counterparties appear on government sanctions lists from the US, OFAC, EU, UN, UK, and so on. These lists include individuals, organizations, and crypto addresses subject to asset freezes. This means that serving sanctioned entities can result in severe fines.

Here is how you do sanctions screening:

- Screen customers at onboarding against sanctions databases.

- Continuously rescreen as lists update (someone could become sanctioned anytime).

- Block withdrawal attempts to sanctioned addresses.

- Freeze accounts and report matches to authorities.

Blockchain analytics tools help by tagging addresses linked to sanctioned entities, and exchanges that fail to screen properly will face enforcement action.

PEP screening identifies politically exposed persons, i.e. individuals holding notable public office, such as politicians, senior officials, military leaders, heads of state-owned companies, and their close relatives. Generally speaking, PEPs aren’t banned or illegal, but they are of higher risk due to potential corruption or bribery.

PEP screening in crypto requires you to:

- Apply Enhanced Due Diligence (EDD) to PEPs.

- Require additional documentation about the source of funds.

- Monitor transactions more closely.

- Get senior management approval.

Exchanges must ask users if they’re PEPs during onboarding and cross-check against global PEP databases. If someone is flagged, compliance teams must request extra documents and increase account monitoring.

Detecting suspicious activity

Beyond KYC and monitoring, exchanges monitor for the use of „mixers”(hiding origins), or high-risk geolocations, or rapid in/out flows – all of these are often linked to cybercrime signaling money laundering.

Here are some common suspicious activity red flags in crypto:

- Mixers and privacy coins: Using mixing services (like Tornado Cash) or converting to privacy coins (Monero, Zcash) to hide transaction trails. Legitimate users rarely need these; criminals use them to launder money or hide stolen funds.

- Structuring: Breaking transactions into smaller amounts to avoid reporting thresholds. Example: making five $9,500 withdrawals instead of one $50,000 withdrawal to stay under $10k limits.

- Rapid movement: Funds hopping through many addresses quickly, called „layering”) to break audit trails and confuse blockchain analysis.

- Geographic risks: Transactions from high-risk or sanctioned jurisdictions, or users frequently changing VPNs to appear from different countries.

- Identity issues: Frequent changes to personal information, shared contact details between accounts, or documents found on stolen ID databases.

- Unusual patterns: Accounts that only receive and immediately withdraw funds without trading (acting as transit points), wash trading, or sudden activity spikes inconsistent with user profiles.

The Crypto Travel Rule Explained

The Travel Rule (FATF Recommendation 16) is a simple concept: when you send crypto worth more than a certain threshold, usually $1,000/€1,000, the sender’s and receiver’s information must „travel” with the transaction.

What the Travel Rule Means for VASPs

Exchanges must now talk to each other. If you send 1 BTC from Exchange A to Exchange B, Exchange A must securely tell Exchange B exactly who you are. This eliminates the „dark corners” of the crypto web where money could move without a paper trail.

How KYC Supports Travel Rule Compliance

Without strong KYC procedures, the Travel Rule would be impossible to implement effectively. The Travel Rule requires exchanges to share customer identity information with each other during crypto transfers. This only works if exchanges have verified that information through KYC first. Without proper KYC measures, shared data is unreliable and useless.

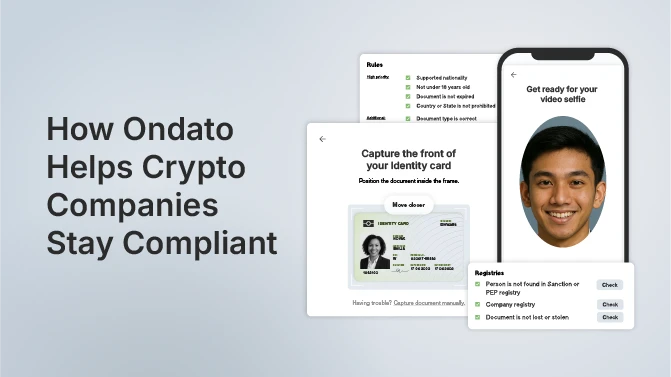

How Ondato Helps Crypto Companies Stay Compliant

Ondato tackles crypto pain points with automation that slashes onboarding time to 30 seconds average, using 15,000+ AML sources for real-time screening. It prevents fraud via biometrics (99.8% accuracy) and supports VASPs without the scalability headaches of in-house builds.

In other words, instead of a clunky, manual process, Ondato provides an all-in-one compliance operating system designed for the speed of the crypto market.

Automated identity verification

Ondato’s IDV scans 10,000+ docs instantly, boosting onboarding pass rates to 97% and ditching manual reviews for seamless crypto sign-ups.

AML screening and monitoring

Ondato performs real-time checks against global sanctions/PEP lists to help you catch risks early, which is vital for VASPs monitoring crypto flows.

Travel Rule compliance support

Ondato aids data gathering for sender/recipient info sharing, easing FATF thresholds like $1,000 equivalents across jurisdictions.

Faster and more secure user onboarding

Onboarding automation cuts drop-offs and improves UX, as users are verified in seconds, building trust without friction.